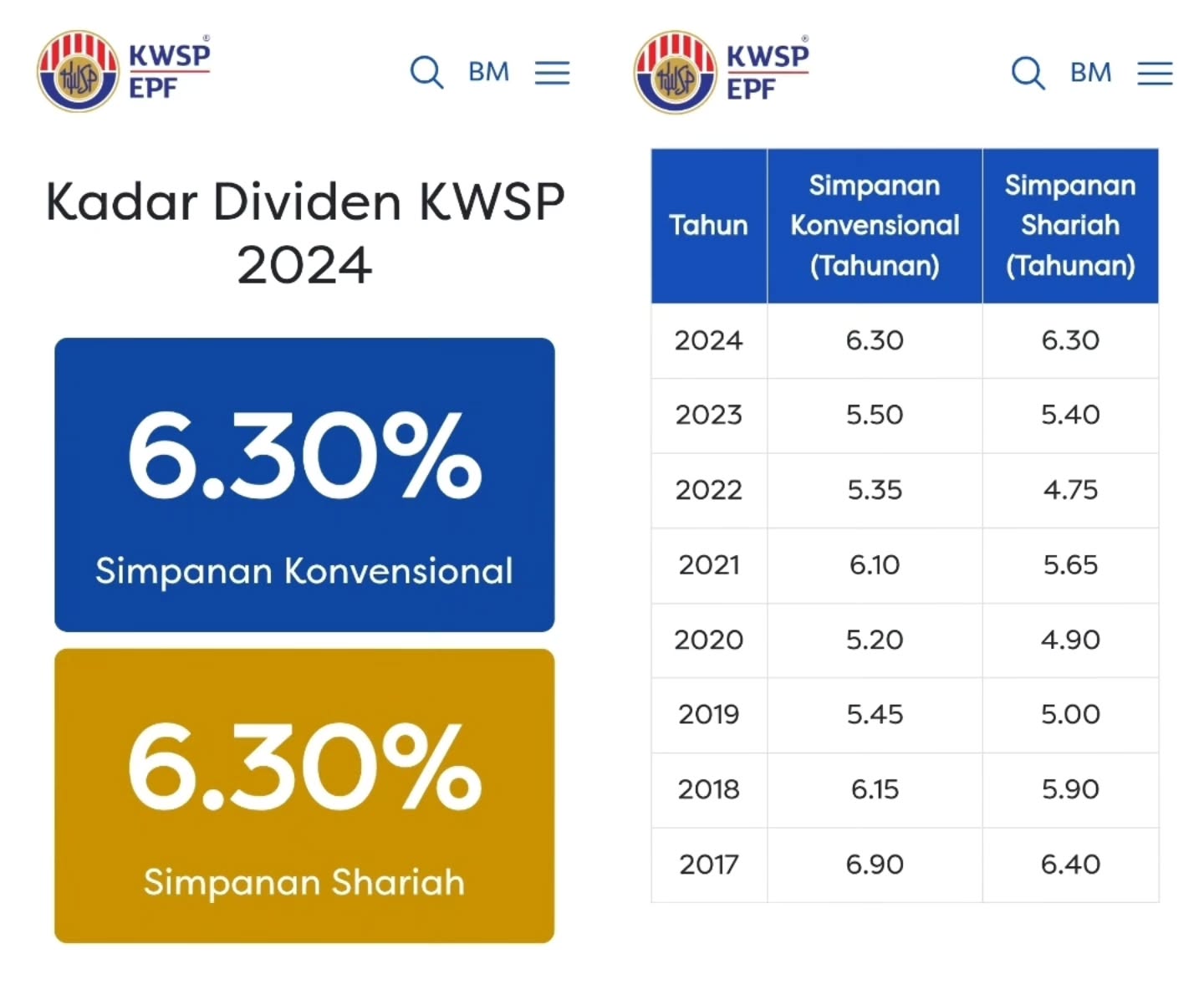

Mesti ramai happy kan bila KWSP isytihar kadar dividen KWSP yang agak tinggi berbanding beberapa tahun sebelumnya.

Terus bukak EPF i-Akaun masing-masing nak tengok berapa baki terkini selepas dividend baru dimasukkan dalam akaun. Banyak betul snapshot tengah menunggu masuk hehe…

Tapi nak tahu tak, dividend yang tinggi ni datang dari mana?

Kalau nak tau mari sini baca.

Tapi maaf ya, we need to switch to English since the explanation is better said in English.

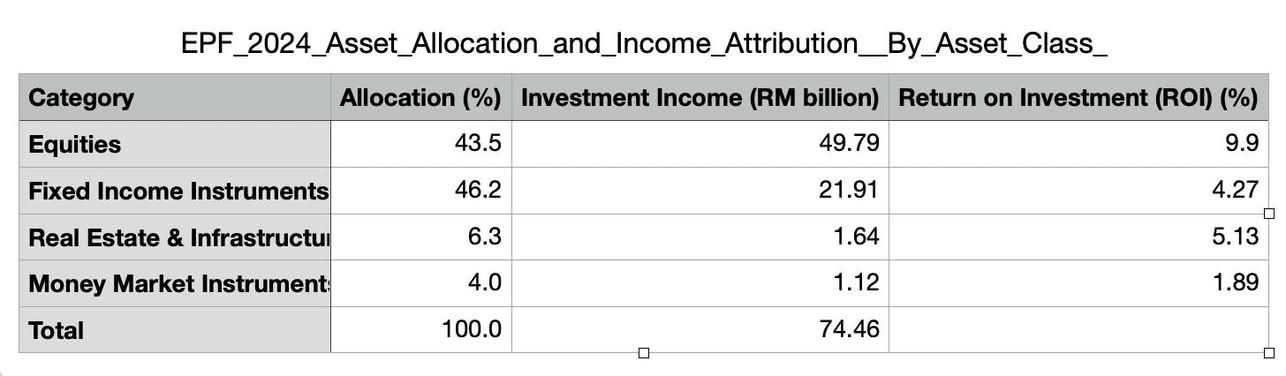

Based on the official announcement made by EPF, the table below summarized the simplified income attribution analysis for 2024.

What does income attribution analysis mean?

It simply means, measuring the return generated by each of the asset classes respectively. This helped us answer the question, what drives the performance of EPF dividend in 2024.

Let’s begin.

1. The higher the risk, the higher the (expected) return. Cash/money market is the lowest risk and gives the lowest return while equity which has the highest risk (within EPF’s asset class spectrum since EPF has no crypto exposure as yet) gives the highest return of 9.9%.

2. Strong equity markets in both local and global markets FBM KLCI (as an indicator of Malaysia’s equity market) rose by 12.9%, which was driven by improved investor sentiment – no longer being considered as politically unstable compared to couple years before as international investors saw Malaysia changed their Prime Minister every other year. Strong performance in the US, developed markets and Asian stock markets (apart from China) has contributed to the strong equity returns as well.

3. Fixed Income remained as stabilizer for what it’s named for – Fixed Income Almost 50% of EPF’s assets are allocated in fixed income (bonds and sukuks), and this has helped to become the anchor as the base for EPF’s returns. As long as there is no credit default, there is potentially zero to low risk of these investments.

There are 2 major insights from the 2024 EPF’s performance.

- Foreign Investments Outperformed Despite Lower Allocation Out of the RM1.25 trillion of assets, only 37% is allocated to foreign investments, and yet it contributed to 50.3% of the investment income for 2024. While we are not provided with the details of the intra asset allocation (how much of the foreign investments are in equity and fixed income respectively), the overall number suggests that foreign investments had higher returns compared to domestic investments, making a strong case for international diversification.

- Domestic Investments Had Lower Efficiency in Generating Income 63% of total assets are invested domestically, but it only contributed to less than 50% of total investment income for 2024. This means that, even though domestic investments (especially in fixed income) have a stabilizing role, they were less efficient in generating returns compared to foreign investments.

So, what can we learn from this?

Despite having a solid strategic asset allocation, what’s more important and sometimes most people miss to focus on, is to have a diversified allocation between different regions as well, not just different types of asset classes. And this is where EPF remains superior, compared to other institutional investors.

As an individual investor, what can we do?

I can’t emphasize this enough and this is something that I’ve mentioned repeatedly in my previous posts – that global diversification in portfolio management is non-negotiable.

If there’s one thing you take away from my writing today, let it be this: Global diversification is key to sustainable portfolio success.

Moral of the story: EPF knows what they’re doing.

And as an ex-employee who used to manage some of the funds in EPF, I know what I’m doing as well.

But as individual investors, are we making the same smart choices?

Let me become your bridge to these valuable knowledge ☺️☺️

- Noorul Azila

- Noorul Azila